In my previous blogposts

1 2 3, I summarized the notes from entrepreneurship course offered by Rice Center for Engineering Leadership. This blogpost will extend the previous blogposts for larger organization based on the notes from the Micro-MBA class at IBM Almaden Research Center. As a disclaimer: this blogpost should be viewed as my personal biased opinions based on limited understanding of the subject, rather than any official position of IBM or the

instructor. Also, I will skip many topics for brevity.

The Micro-MBA course can divided into following three sub-topics:

- Economics

- Finance

- Accounting

Economics

The fundamental assumption of economics is of

scarcity: People have unlimited wants but limited resources, namely:

- Labor (human time and work)

- Natural resources (raw materials)

- Capital (man-made materials needed for the production of other goods such as buildins and machinery).

Hence, we have to

chose how to use the limited resources to maximize our wants and needs. An economist studies the choices to following three fundamental questions:

- WHAT (goods and services) to produce ?

- HOW to produce them ?

- WHO will receive the goods and services produced ?

WHO will receive the goods and services produced ?

The answer to the third question depends on what are the economic policies of the country. In a country with

centrally planned economy such as Cuba and North Korea (and Soviet Union from 1917 to 1991), the government decides how the goods and service produced be allocated. On the other hand,

in market economy, the individuals/households/firms who are most willing and able to buy the goods and services receive them (i.e. based on principle of supply and demand). Note, most countries today follow

mixed economy, where most economic decisions results from the interactions of the buyers and sellers in the market, but in which the government plays a significant role in the allocation of resources [1].

| Centrally planned economy | Market economy |

|---|

| Productive efficiency (produced at lowest cost) | | Better |

| Allocative efficiency (reflects consumer preferences) | | Better |

| Equity (fair distribution of goods and services) | Better | |

| Freedom | Better for freedom from uncertainty | Better for freedom of choice |

| Main proponent | Karl Marx, who posited in Das Kapital that market competitions exploits labor and ultimately fosters monopolies. | Adam Smith, on the other hand claimed that competition and the self-interested pursuit of profit causes the firms and the individuals to behave in ways that are ultimately socially beneficial. |

WHAT (goods and services) to produce and HOW to produce them ?

As described above, in a market economy, self-interested pursuit of profit motivates people to decide what goods and service to produce. The profit is high if the consumer is willing to buy the goods and service for higher price that the cost of goods and service. Every economic decision that a consumer makes takes account of utility (the amount of benefit to the consumer) and comes with an opportunity cost [3].

Opportunity cost is the benefit, profit, or value of something that must be given up in order to have something else.

Opportunity cost

Let's understand opportunity cost by examining the problem of whether I should have done

PhD after my Masters. After my Masters, I had two options:

- Accept the job offer for Software Development Engineer (SDE) position in Microsoft SQL Server Data Mining team. The salary of this position is $ x per year.

- Do 5-year PhD program at Rice university. Rice University gives PhD students a stipend of $ y per year. After PhD, I got an offer from IBM Research with a salary of $ x + z per year.

Assuming the compensation at Rice, Microsoft and IBM remain constant, the opportunity cost associated with doing a PhD after

n years is $

x*n - (x + z)*(n - 5) - 5y. The below figure (generated by crude approximation) shows that it makes sense to do PhD if

n > 10.5, where the opportunity cost becomes 0.

The above example ignores the rate of increase of compensation of a Masters vs PhD student and also the intangible costs such as experience at Microsoft, potential cutting-edge role at IBM, guidance under Chris, etc.

Specialization and Voluntary Trade

In the book

The Wealth of Nations, Adam Smith highlights that two key points:

- Workers produce more when they occupy specialized roles, so businesses can offer higher quality products at lower prices.

- Trade benefits both buyer and seller (i.e. lower opportunity cost for both of them). Note, this is only true iff both the buyer and seller are engaged in the trade voluntarily and if both have complete information. The counter-examples for voluntary exchange are slavery, human trafficking and fraud, where government regulations are necessary.

To summarize, a corporation should attempt to:

Step 1:

specialize such that it is the lowest cost provider

Step 2: apply

opportunity cost in decision making, risk assessment (risk vs return) and pricing analysis (for example: if supply is high, price is $1 less than second cheapest seller and if supply is low, the price is $1 more than second highest bidder/buyer).

Step 3:

exchange between two opportunity cost such that both parties are better off (i.e. producer sells to make profit and the consumer buys as it is more expensive to make it).

Monetary system

Except countries like Germany, South Korea, Switzerland, Norway, etc, the government spends more than its revenues. The difference is called as deficit spending or budget deficit or simply deficit.

To pay for the deficit, the Treasury borrows the money from the banks by issuing them treasury bonds. Treasury bonds offer interests and promise by the government to pay the principal and hence are considered as safest investments. However, in recent times, countries like Ukraine, Argentina, Greece, Zimbabwe and Russia were either defaulted or had to restructure their debts (see

wikipedia for the exhaustive list). The big three rating agencies - Standard & Poor's, Moody's and Fitch - rate countries on their ability to pay interest, refinance and repay them.

Then through Open Market Operations (or OMO), the banks gets to sell the treasury bonds (or mortgage-backed securities) to the Federal Reserve (or Fed for short) at a profit. Interesting point to note here: Banks give Fed the treasury bonds and Fed adds "credit" to the bank reserves. As countries' central bank, Fed has unique power to create credit out of thin air without having money to back the credit up ... often referred to as "printing money".

Other than buying treasury bonds, Fed has another tool at its disposal: the

reserve requirement (or cash reserve ratio or liquidity ratio), which refers to percentage of cash that must be kept at Fed or in the vault by a commercial. If a bank makes too many loans or if there is a sudden demand for withdrawals, then amount on money in the bank's vault falls below the reserve requirements. In this case, the bank first attempts to borrow money from other banks at the

fed funds rate and then the remaining amount from the Fed at the

discount rate. An equivalent interbank lending rate to feds funds rate in UK is LIBOR rate - the London Interbank Offered Rate (set by the British Banker's Association).

In practice, there is no standard fed funds rate, instead it is the weighted average of the interest rate banks charge each other overnight to meet the reserve requirements. The Federal Open Market Committee (FOMC) meets eight times a year to set the target fed funds rate and then by buying/selling of treasury bonds, it attempts to achieve the target fed funds rate. The Fed funds rate affect the prime rate (for setting home equity lines of credit, auto loans, personal loans and credit card rates) and 11th District cost of funds index (for setting adjustable-rate mortgages).

|

Jan 2018

|

Dec 2017

|

Jan 2017

|

Prime rate reported by the Wall Street Journal's bank survey

|

4.5

|

4.25

|

3.75

|

Discount rate

|

2

|

1.75

|

1.25

|

Fed funds rate

|

1.5

|

1.5

|

0.75

|

11th District cost of funds

|

0.746

|

0.737

|

0.603

|

Treasury then can use the money it received by selling the bonds to fund the deficit. Bank can use the credit it received from Fed and the money deposited by its customers minus the reserve requirements to make loans. This is called as fractional reserve lending and it works as follows. Let's assume that reserve requirements is 10% and X deposits $1000 in bank A. The bank A keeps $100 in its vault and lends remaining $900 to Y who needs it to fund her business. Y has an account in bank B and deposits $900 in her account which she intends to remove as and when needed. Bank B keeps $90 in its vault and lends remaining $810 to C who in turns deposits in bank W. Now, when A, B and C check their accounts in their respective banks, they will see that they have $1000, $900 and $810 respectively, that is the initial $1000 has grown to $2710 in the economy. This system fails if there is a mass panic and A, B and C all decide to remove the amount at once (commonly referred to as bank run).

Before we move ahead, it is a good idea to classify different types of banks:

- Supranational banks:

- The International Monetary Fun (IMF) ensures the stability of the international economic system and has 187 member countries.

- World bank provides financial help to combat poverty, malnutrition and lack of communications and infrastructure to the developing countries.

- Central banks such as Federal Reserve, European Central Bank, Bank of England, Reserve Bank of India (RBI), Swiss National Bank and The People's Bank of China (PBC), set monetary policy described in the below section.

- Commercial bank's business model is to charge higher interest rate for loan than they pay depositors.

- Investment banks provide three functions: Merger and Acquisition (M&E) facility for corporations to raise debt or equity, Institutional Client Services which includes Fixed Income, Commodities and Currencies (FICC) and Asset/Wealth Management for high net worth clients.

Government intervention

The government keeps the economy growing (close to long-run trend rate of 2.5%), limits unemployment and keep inflation low (inflation target of 2%) by fiscal and monetary policies:

- Fiscal policy: is set by the US Congress, the President and the Treasury Secretary, which involves changing government spending and taxation.

- Monetary policy: is set by the central bank (i.e. Federal Reserve in US), which involves influencing the demand and supply of money, primarily through the use of interest rates.

Inflation refers to a general increase in the price of goods and services and is caused by increase in the supply of money. Though it is hard to define/measure precisely, it is commonly measured by consumer price index (or CPI) which is weighted average change in the prices of consumer goods and services. Government love inflation but just to the right amount (~2%) as it makes debt cheaper (as dollar becomes cheaper), increases taxes (as prices increases) and increases exports. On the other hand, fixed income retirees and importers (such as oil) hate inflation.

A country is in recession when two successive quarters, or a six months, show a decrease in real GDP. Hence, during recession, we get a fall in the inflation rate. However, deflation is when we get a negative inflation rate i.e. falling prices. Since the second world war, recessions have not led to deflation – just a lower inflation rate. A depression is a severe recession.

|

Fiscal Policy

|

Monetary Policy

|

|

Set by:

|

US Congress,

President and Treasury Secretary

|

Federal Reserve

|

Measured by

|

Tax

|

Spending

|

Interest Rates

|

Treasury Bonds

|

Reserve

requirements

|

Inflation

|

Prices ↑

|

Consumer Price

Index (CPI)

|

↑

|

↓

|

↑

|

Sell

|

Increase

|

Recession

|

Low output and unemployment

|

GDP/GNP, Unemployment

rate

|

↓

|

↑

|

↓

|

Buy

|

Decrease

|

For example: to reduce inflationary pressures,

- a fiscal policy will involve higher taxes and lower spending. The advantage of using fiscal policy is that it will help to reduce the budget deficit, but is often difficult to implement due to political reasons.

- a monetary policy (in this case termed as tight monetary policy) will attempt to reduce the supply of money by raising the interest rates and borrowing rates among banks, selling government bonds (also called as "open market operations" or OMO) and by increasing the rate of minimum reserve to be kept by commercial banks towards central bank.

Extreme situations:

- Buying too many treasury bonds: During extreme recession or to avoid deflation, Fed buys lots of government debt so as to inject more money into economy and encourage growth. This is called as Quantitative Easing as was pioneered by the Bank of Japan in 1990s. In 2009 financial crisis, Fed and Bank of England purchased over $2 trillion and $520 billions government debt respectively.

- Comprehensive Financial Reform Acts:

- After 1929 stock market crash, Glass Steagall Act was enacted which separated investment banking from commercial/retail banking to prevent bank run. This act was repealed in 1999 by the Gramm-Leach-Bliley Act allowing the banks to invest depositors' funds in unregulated derivatives. This led to banks becoming too big to fail and requiring bailout in 2008-2009 to avoid another depression.

- After 2008-2009 housing crisis, Dodd-Frank Act was passed which increased regulations on unregulated derivatives trading and created Consumer Finance Protection Bureau that took actions against predatory student lending practices and payday loan scams. Much of these regulations might be rolled back Financial CHOICE Act is enacted.

- Stagflation (= Inflation + Recession at the same time) is a condition of slow economic growth and relatively high unemployment accompanied by a rise in prices, or inflation. It occurs due to supply shock (such rapid increase in price of oil) and due to policies that harm industry while growing money supply too quickly. Venezuela is an example of stagflation where if you fix inflation, you create depression and if you fix recession, you create hyperinflation.

- When inflation rate increases by ~ 50% monthly, it is referred to as hyperinflation. Germany after Treaty of Versailles (322% inflation rate), Hungary in 1945 (19,000% inflation rate) and Zimbabwe in 2008 (230 million % inflation rate) had some of the examples of hyperinflation.

Economist track the economic growth, unemployment and inflation using the following three measurements:

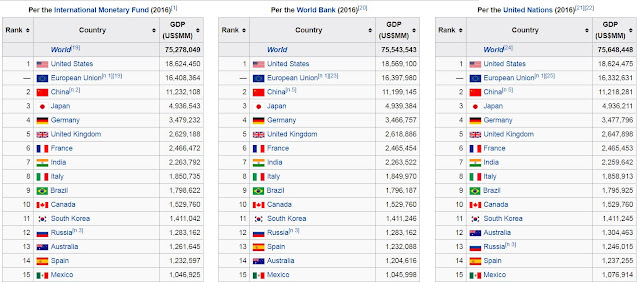

1. Gross Domestic Product (GDP): is the value of all the finished goods and services (hence product) produced within a country's border (hence domestic) in a specific time period, usually a year.

- Since it is "gross", the depreciation in the capital asset is not deducted. If it where deducted, then it becomes "net".

- Since it is "domestic", it does not take into account the country's earning outside its geographical boundaries, or foreign remittances. Gross National Product (GNP) is GDP + income earned by residents from overseas investments - income earned within the domestic economy by overseas residents.

- Since it is "product", the intermediate goods are not taken into account. For example, wheat sold for final consumption to consumers will be included into GDP, but not the amount of wheat sold to bakeries for the production of bread.

- GDP is commonly used as an indicator of the economic health of a country and can be computed in three principal ways: from total output, from income and from expenditure.

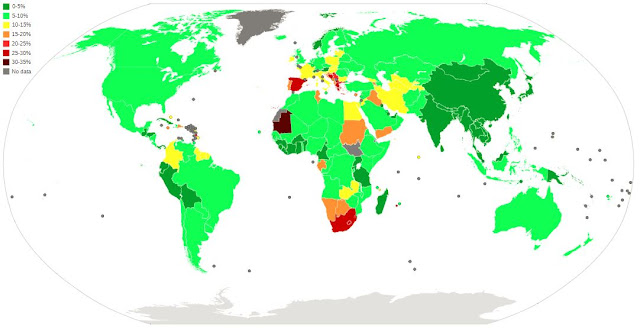

2. Unemployment rate: is the number of unemployed people is divided by the number of people in the labor force times 100. Note, it defines unemployed people as those who are willing and available to work, and who have actively sought work within the past four weeks. Hence, little kids don't count, neither do people who are unable to work due to their age or disability or who chose not to work. The below figure shows the unemployment rate per country in 2013:

3. Inflation rate: measured by consumer price index (or CPI).

Reference:

1. Economics - Hubbard and O'Brien.

2. https://www.investopedia.com/

3. The Book of Money - Conaghan and Smith.

4. Macroeconomics: Crash Course: https://www.youtube.com/watch?v=d8uTB5XorBw

5. The Monetary System Visually Explained: https://www.youtube.com/watch?v=23DNe0cJhcU

6. https://www.thebalance.com/open-market-operations-3306121

7. https://www.bankrate.com/rates/interest-rates/prime-rate.aspx

8. https://www.thebalance.com/dodd-frank-wall-street-reform-act-3305688